Protect your construction business from CRA penalties and accounting headaches with expert bookkeeping

Great businesses have properly kept books.

Why outsource your bookkeeping?

Peace of Mind

Know an expert has kept your books up to date

Sleep better knowing your APs and ARs are being managed

Take Your Time Back

Spend more time working on your business, not bookkeeping

Increase your ability to earn with more time

Avoid CRA Penalties

Accurate books keep the CRA happy

In the case of an audit, accurate books make the process smoother and easier

What's Included With Your Bookkeeping Services

Tired of spending so much money but not understanding where it is going? Our services are the key solution!

Payroll

Employees paid on time

Tax & other deductions correctly calculated

Accurate pay stubs and T4s

Guaranteed CRA compliance

Tax Filing Ready Books

Monthly bookkeeping entries

Prepared financials for T2 filings

CPA certified accuracy

Guaranteed CRA compliance

AP & AR Management

Ensure all invoices are paid on time

Pay suppliers before the due date

Ensure AP are fuelling business growth

Guaranteed CRA compliance

Why Choose Persistent Bookkeeping Services?

We like you already! Here is why you'll love working with us.

Cost

Save tens of thousands of dollars on bookkeeping by choosing Persistent Bookkeeping Services over hiring an in-house bookkeeper. Our average client can save upwards of $50,000 per year

Accuracy

Our team of registered bookkeepers bring experience to your business's books. We ensure that your bookkeeping is kept up to date on a monthly basis helping a stress-free and simplified tax filing.

Peace of Mind

It is easier to sleep knowing your business's books are taken care of. Working with Persistent Bookkeeping Services allows you to sleep better and be more confident in your business knowing your books are taken care of!

Welcome To Persistent Bookkeeping Services

Focus on Growth, Not Bookkeeping!

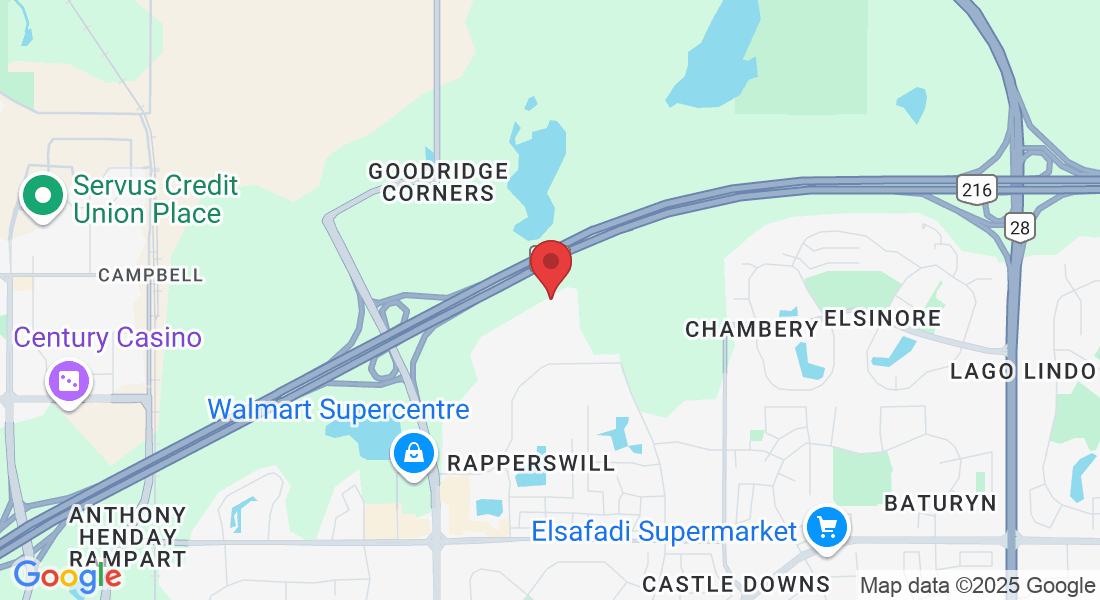

Managing a construction business is demanding—handling complex bookkeeping shouldn't add to your load. At Persistent Bookkeeping Services, we specialize in construction bookkeeping, allowing you to focus on building projects and increasing profits.

Our tailored bookkeeping services address the unique challenges of the construction industry, such as job costing, progress billing, and compliance with industry-specific regulations. With our meticulous approach, every account remains accurate and current, ensuring you're well-prepared for tax season and financial reviews.

Let us shoulder the bookkeeping responsibilities, so you can concentrate on what you excel at—delivering quality construction projects and growing your business.

Fitiwi Tsigeyohannes

Ready To Get Your Bookkeeping In Order?

Other industries we serve

Include but not limited to...

Dentists

pharmacies

restaurants

Lawyers

contractors

tradespeople

Doctors

natural resource providers

retail stores

You ARen't the first to ask these

Frequently Asked Questions

How much time can I save by hiring Persistent Bookkeeping Services?

Although it depends on how many transactions your business does, our expert bookkeepers are efficient and accurate. Our clients typically save between a minimum of 3 hours per month and have better kept books that are easier to explain to the CRA if they are audited.

Which kinds of businesses need to outsource their bookkeeping?

All businesses benefit from bookkeeping, including small businesses, freelancers, startups, and corporations. It ensures you stay on top of financial obligations and make data-driven decisions.

Can you help with GST/HST filing and compliance?

Absolutely! We ensure your GST/HST filings are accurate and submitted on time, helping you avoid penalties and stay CRA-compliant.

Can you clean up old or messy books?

Yes, we specialize in organizing and reconciling historical records to ensure your books are clean, accurate, and ready for future growth.

Do you offer virtual or online bookkeeping services?

Absolutely! We offer secure, cloud-based bookkeeping solutions that allow you to access your financial data anytime, anywhere.

What is the difference between a bookkeeper and an accountant?

Bookkeeping records daily financial transactions, while accounting focuses on analyzing and interpreting that data for tax filing, reporting, and strategic planning.

How can a bookkeeper help my business?

A bookkeeper ensures your financial records are accurate and up to date, helping with cash flow management, tax preparation, payroll, invoicing, and compliance with CRA regulations.

Why should I hire a professional bookkeeping firm instead of managing my books myself?

Professional bookkeepers ensure accuracy, compliance with tax regulations, and timely financial reporting, allowing you to focus on growing your business without the stress of managing financial records.

How often should my business's books be updated?

Regular updates are crucial. Depending on your business's complexity, we recommend updating your books either weekly or monthly to ensure accurate financial tracking and reporting.

Can you assist with GST/PST filings and compliance ?

Yes, we handle all aspects of GST and PST compliance, including accurate calculation, timely filing, and remittance to ensure your business adheres to provincial tax regulations.

What measures do you take to ensure the confidentiality and security of my financial information?

We implement strict data security protocols, including encrypted communications and secure cloud storage solutions, to protect your sensitive financial information.

What is the process for transitioning my current bookkeeping system to your services?

We conduct a thorough assessment of your existing financial records, develop a customized transition plan, and ensure a seamless migration with minimal disruption to your operations.

Get Started With Persistent Bookkeeping Services Today!

Who needs our bookkeeping services:

Small businesses (including sole proprietors)

Corporations

Franchises

Startups

All businesses